The Ministry of Ecology and Environment recently released the “2026 Ozone-Depleting Substances (ODS) and Hydrofluorocarbons (HFCs) Quota Total Setting and Allocation Plan (Draft for Comment),” clarifying the following core provisions: Based on the Montreal Protocol and its Kigali Amendment, HCFC production/use in 2026 will be reduced by 71.5%/76.1% from baseline levels, while total HFC production/use will remain at baseline (1.853 billion metric tons of CO₂ equivalent). HCFC quotas will be reduced proportionally based on historical production levels. Additional quotas for HFC alternatives will be allocated (HFC-245fa: +3,000 tons; HFC-41: +50 tons) to support transition needs in key industries. A “three-tier verification system” will be implemented (pre-review of quota applications + annual compliance verification + mid-year adjustment review) to rigorously combat illegal production and over-quotaactiviies.

#01

Production Quota Allocation

1. HCFC Quotas: Accelerated Phase-out and Targeted Regulation

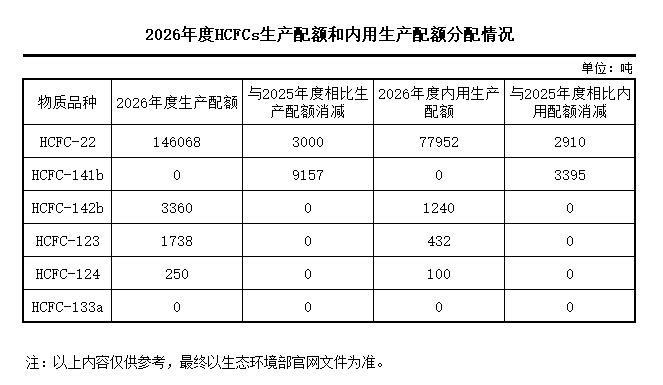

2026 production quota: 151,400 metric tons (71.5% reduction from baseline); consumption quota: 79,700 metric tons (76.1% reduction). Quotas allocated based on historical production shares; units with no production for three consecutive years receive priority quota reductions.

HCFC-141b: Production quota reduced to zero, compelling the polyurethane foam industry to transition to alternatives like HFC-245fa.

HCFC-22: Quota of 146,000 tons retained to support industrial/commercial refrigeration and air conditioning maintenance market demand.

2. HFC Quotas: Total Freeze with Structural Adjustments

Production/domestic use quota: 1.853 billion metric tons of CO₂ equivalent. Import quota: 0.1 billion metric tons of CO₂ equivalent. Enterprises may apply for two quota adjustments within the year (April 30 and August 31), increasing flexibility by 30%.

HFC-245fa: New quota of 3,000 tons (all for domestic use) to fill the gap left by HCFC-141b phase-out.

HFC-41: New quota of 50 tons (all for domestic use) to ensure supply for semiconductor etching processes.

#02

Market Impact Analysis

1. Supply Side: Structural Imbalances Emerge

Accelerated HCFC Phase-out: HCFC-141b production will cease by 2026, creating a 121,000-ton gap in the blowing agent market. Substitutes like HFC-245fa and cyclopentane are experiencing explosive growth.

HFC Concentration Rises: Leading firms (e.g., Juhua, Dongyue) consolidate market share through quota advantages, while SMEs face capacity consolidation pressures.

2. Demand Side: Substitution Drives Growth

Refrigerant Sector: HCFC-22 demand remains rigid in AC maintenance markets, but new installations shift toward low-GWP HFOs; R1234yf penetration exceeds 30% in automotive applications.

Chemical Industry: Surging demand for HFC-245fa is driving upgrades across the fluorochemicals supply chain, projected to boost demand for electronic-grade hydrofluoric acid, tetrafluoroethylene monomer, and other raw materials by 15%-20%.

3. Price Trend Forecast

HCFCs: HCFC-141b prices may surge to 60,000 yuan/ton (+20%), driving synchronous increases in substitute HFC-245fa prices.

HFCs: Under frozen total quotas, mainstream refrigerants like R32 and R134a will maintain high-level volatility, while premium margins for new energy vehicle refrigerants narrow.

The 2026 quota plan marks China's transition to a new phase of ODS/HFCs governance characterized by “strict total volume control + structural optimization.” Enterprises must prioritize compliance while leveraging technological innovation as an engine to identify new growth drivers amid dual objectives of compliance and development. We recommend closely monitoring fourth-quarter quota issuance progress and the pace of substitute capacity deployment to capitalize on structural opportunities.