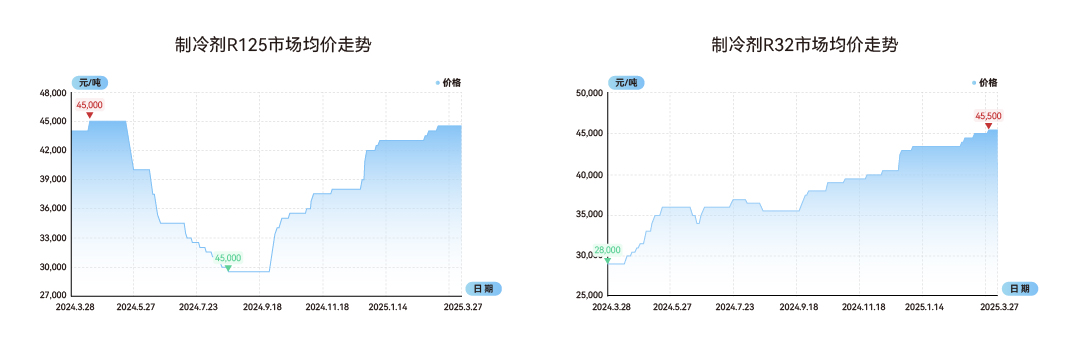

Recently, the domestic refrigerant R410A market has shown a high-level stabilization trend, driven by the high prices of R125 and R32, and the short-term bullish expectations continue to strengthen. The strong demand for downstream air conditioning production has led to enterprises prioritizing the supply of air conditioning manufacturers, resulting in a tightening of the market's available commodity volume. The mainstream ex factory quotation remains in the range of 45000 to 46000 yuan/ton, and the actual transaction price varies due to differences in order size and cooperation depth.

According to online monitoring data from the root industry, the

production of household air conditioners showed significant growth from

April to June 2025: the domestic market produced 13.42 million units in

April (+9.1% year-on-year), 14.62 million units in May (+17.4%

year-on-year), and 13.85 million units in June (+31.1% year-on-year); In

terms of exports, 10.58 million units were scheduled for production in

April (+7.5% year-on-year), 9.33 million units in May (+2.8%

year-on-year), and 7.46 million units in June (-10.9% year-on-year). The

strong recovery of the domestic market has become the core driving

force supporting the demand for refrigerants.

The transmission

pressure of raw material costs continues to emerge. As of last week, the

average market price of 97% fluorite wet powder in China reached 3752

yuan/ton, with significant regional price differences: 3500-3550

yuan/ton in North China, 3600-3700 yuan/ton in Central China, and

3750-3900 yuan/ton in East China. Affected by stricter safety and

environmental regulations, the operating rate of fluorite mines is

running at a low level, the supply increment is limited, and combined

with inventory consumption, the tight supply of acid grade fluorite

powder has not changed. The average market price of industrial grade

anhydrous hydrogen fluoride remains at 11410 yuan/ton, and the regional

price difference remains in the range of 200-400 yuan/ton. The cost

support and supply-demand balance jointly promote the hydrogen fluoride

market to show a stable and waiting to rise pattern.

Based on

comprehensive analysis, the R410A market is expected to continue its

high-level transition trend in the short term. The demand for air

conditioning production during the peak season continues to release,

coupled with the support of raw material costs and the impact of quota

control policies, leading to a bullish sentiment in the market. It is

recommended that maintenance companies and equipment manufacturers

closely monitor supply and demand dynamics, and plan procurement plans

in advance based on production cycles to cope with potential price

fluctuations.

Related articles

-

2025-10-30

Market Dynamics: Dual-Track Analysis of Refrigerant Market's Steady Uptrend and Quota Adjustments

News -

2025-09-22

Green Mission: 40 Years of Global Collaboration in Ozone Recovery and the Refrigerant Industry's Responsibility

News -

2025-09-08

Market Dynamics: Hidden Price Hike Trends in Refrigerant Supply-Demand Balance

News